What is the Debt Ceiling?

The debt ceiling is the legal limit on the total amount of federal debt the government can accrue. The limit applies to the roughly $24.6 trillion of debt held by the public and the roughly $6.8 trillion the government owes itself as a result of borrowing from various government accounts, like the Social Security and Medicare trust funds. Federal debt continues to rise due to both annual budget deficits financed by borrowing from the public and from trust fund surpluses, which are invested in Treasury bills with the promise to be repaid later with interest.

History of the Debt Ceiling

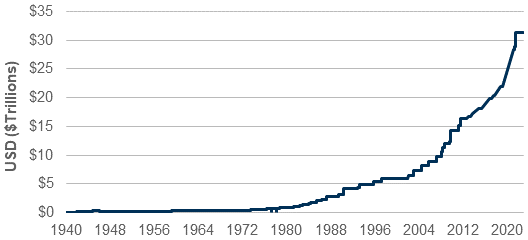

The debt ceiling was first enacted in 1917 through the Second Liberty Act. Prior to its establishment, Congress was required to approve each issuance of debt in a separate piece of legislation. Since the end of World War II, Congress and the President have modified the debt ceiling more than 100 times, according to the Congressional Research Service. In that time frame, the debt limit increased from $300 billion to just under $31.4 trillion.

Historical U.S. Debt Limit

Source: U.S. Treasury. Data from 6/25/1940 – 5/15/2023.

Source: Committee for a Responsible Budget, First Trust Advisors L.P. The information presented is not intended to constitute an investment recommendation for, or advice to, any specific person. By providing this information, First Trust is not undertaking to give advice in any fiduciary capacity within the meaning of ERISA, the Internal Revenue Code or any other regulatory framework. Financial professionals are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients.

All electronic messages sent and received by Investment Planners and IPI Wealth Management (respectively, IPI) are subject to review by IPI. IPI may retain and reproduce electronic messages for state, federal, or other regulatory agencies as required by applicable law.

IMPORTANT: Please do not use e-mail to request or authorize the sale of any security, send fund transfer instructions or otherwise conduct any securities transactions. Any requests, orders, instructions, or time-sensitive messages sent by e-mail cannot be accepted or processed by IPI. The accuracy of any information sent by IPI through e-mail cannot be warranted or guaranteed by IPI.

The information in this e-mail and any attachments are for the sole use of the intended recipient and may contain privileged and confidential information. If you are not the intended recipient, any use, disclosure, copying or distribution of this message or attachment is strictly prohibited. If you believe that you have received this e-mail in error, please contact the sender immediately and delete the e-mail and all of its attachments.